Over the past couple of years, we’ve been engaged by firms who had made a strategic investment in Robotic Process Automation (RPA) products – yet were looking for something ‘extra’. Like all technologies, RPA is great when used properly. But it can also turn into a very costly mistake.

In a previous blog article, I described how CIOs were running out of places in which it was ‘safe’ to use RPA. The story then, as now, was that their systems were either ungoverned or the processes unstructured. Put simply, a bot cannot be intelligent enough to pre-empt the unpredictable or resilient enough to cope with systems change.

What Do RPA Solutions Miss?

A Contact Center survey by ContactBabel has shown that the cost of navigating within and between applications was approx. GBP 4.3B per year; and that was for the UK only! Interestingly, that number is higher than the previous year despite the availability of RPA solutions.

Don’t get me wrong. I’m a big fan of RPA – in all its guises – but the end-user desktop is evolving into something new and more challenging. The problem is that as desktop automation takes away the tedium, what is left behind are those processes and process fragments, that are complex, high-value and exploratory in nature. These are scenarios where either humans are the only possible ‘tool’ for the job or where the process requires one human to converse with another to get the reassurance that decisions and transactions will be correct.

How to Enhance RPA with a Desktop Integration Platform?

The solution is to blend RPA with desktop integration. You can automate repetitive and predictable tasks by using a bot, while the inter-application user journey can be optimized using a desktop integration platform. Let me explain…

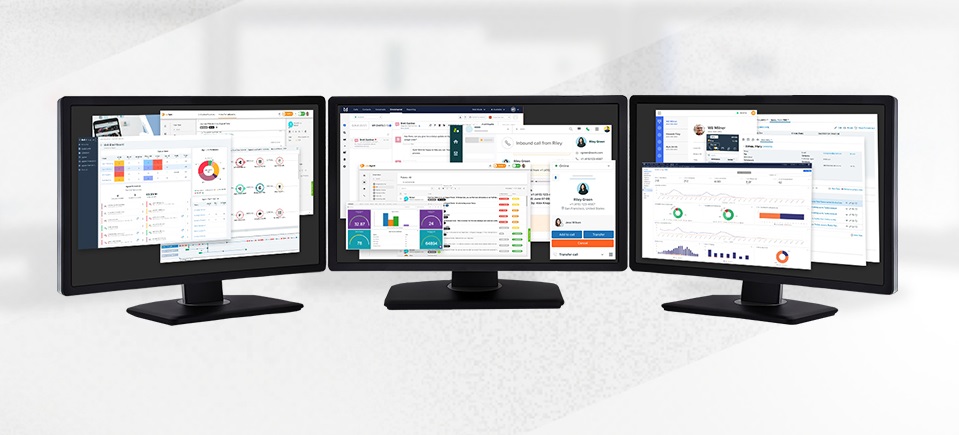

This image shows a typical desktop environment:

Multiple applications (in-house and pre-packaged) fighting for screen real estate while managing entirely separate data stacks. Sure, a large organization could try and do back-end integration to synchronize data, but what impact would that have on the front end? Until now, organizations either built new monolithic front-end apps or looked the other way and ignored the user’s frustrations.

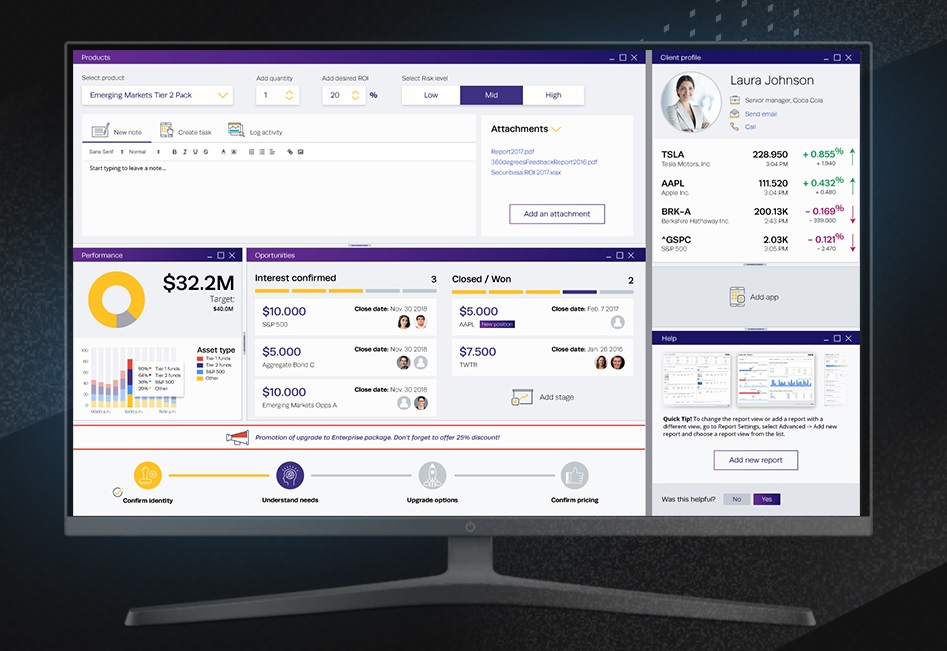

This screenshot shows the same process – but this time with real-time sharing of the data context between applications:

Change the selected client, contact, address, stock, product, etc. in one application, then all the others will be updated immediately. Applications are revealed at just the right point in the process and may reside behind a tab when not needed. Critically, these are the original applications and the user can move within or across them without restrictions as they explore the data sources and attempt to resolve the task at hand. In addition, you can save/share and restore the entire frame that hosts these applications (called a Workspace). The end-user can also reconfigure it if they want to add/remove applications.

End-User Benefits of Using a Desktop Integration Platform

Desktop integration platforms are therefore a bit like an RPA platform in the sense that they simplify and optimize the user flow. The difference is that they can orchestrate the entire user experience and bi-directionally synchronize data between applications. Better still, it doesn’t do it through a fragile UI coordinate or tag approach – but instead uses a fully-fledged message bus to ensure that the integration is always loosely coupled and robust. Moreover, a desktop integration platform will orchestrate the window/application navigation, manage notifications, provide universal search mechanisms and also monitor user behavior.

If you are unfamiliar with desktop integration platforms, check out this article to understand more.