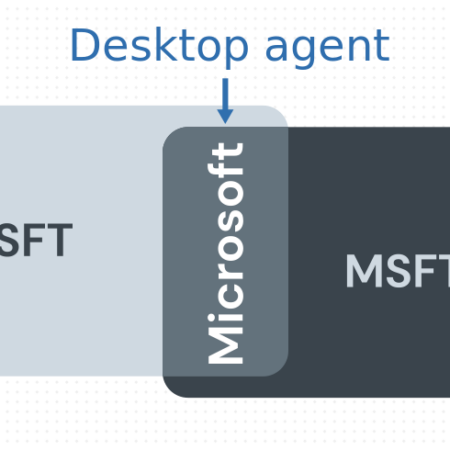

In this post, learn how the concept of “interoperability everywhere” extends workflows across all devices — phone, tablet, or desktop. Traders can walk away from their workstation and continue tasks from anywhere.

In this post, learn more about the technological revolution of the Desktop Superapp. Our guest bloggers cover the UI Ecosystem, which is one of the four critical pillars along with Interoperability, seamless user experience and governance.

Dwayne Middleton, Global Head of Fixed Income Trading at T. Rowe Price, explores the workflow challenges that buy-side fixed income traders face and interoperability’s power to address them.

Discover the transformative potential of interoperability in building out best-of-breed trading platforms.

This post covers the what and the why of The Desktop Interoperability Maturity Model. Learn why the inerop.io team began this project and what makes this guide useful for interop practitioners.

In this post, learn how the concept of “interoperability everywhere” extends workflows across all devices — phone, tablet, or desktop. Traders can walk away from their workstation and continue tasks from anywhere.

Three interoperability

examples from the field

The interop.io team learns every day how we can solve the industry’s biggest (and most specific) use cases by visiting clients and prospects in the real world. Check out these interoperability examples and see how interop.io can help your firm.

In this blog post, I’ll walk you through why FDC3 2.0 brings an important moment to the standard and interoperability across the industry.

Interoperability (or interop for short) has gained popularity in the last few years because it helps simplify user journeys within and across desktop applications. Тhis is a high priority for institutions that need to accelerate their digital transformation and become more efficient.

In any multi-step workflow, there are actions and responses to actions. These actions are composed of data context and intents—the core of FDC3. In this post, we’ll break down two key specifications of FDC3 to give them a closer look.

In this post, learn more about the technological revolution of the Desktop Superapp. Our guest bloggers cover the UI Ecosystem, which is one of the four critical pillars along with Interoperability, seamless user experience and governance.

In this FlexTrade Demo covering interop aand FDC3 workflows, learn more about how FlexTrade benefits from the power of interop, offering FDC3-workflows for execution management and trader workflow. Presentation and demo presented by Andy Mahoney, Managing Director at FlexTrade.

interop.io has won the “Best Desktop Environment for Interoperability” award, recognized at the Trading Tech Insights Awards – Europe. In this post, learn what sets interop.io apart.

In this post, discover the benefits The Desktop Interoperability Model has for software vendors and system integrators, such as a better understanding of your client’s interoperability goals and making your own offering interoperable.

This post covers the what and the why of The Desktop Interoperability Maturity Model. Learn why the inerop.io team began this project and what makes this guide useful for interop practitioners.

In this post, learn how the concept of “interoperability everywhere” extends workflows across all devices — phone, tablet, or desktop. Traders can walk away from their workstation and continue tasks from anywhere.

Lab49 and interop.io announce joint implementation partnership to deliver the future of the trader desktop

Three interoperability

examples from the field

The interop.io team learns every day how we can solve the industry’s biggest (and most specific) use cases by visiting clients and prospects in the real world. Check out these interoperability examples and see how interop.io can help your firm.