Application Interoperability

for Sell Sides

Optimize sales and trading workflows.

Bring your interoperability project to life.

The problem of inefficient sell-side workflows

Broker-dealers and investment banks need to maximize the value they provide to their customers. Salespeople must combine in-depth knowledge of their client’s needs, trading habits and objectives, along with comprehensive knowledge of markets, tradable instruments and trends. Traders must understand market dynamics and liquidity, acting quickly on massive amounts of information to accurately and profitably make markets. Unfortunately, critical information like order details, TCA, client profiles and market intelligence often sit in multiple, disconnected applications. Both must constantly switch, search and copy/paste between them, sometimes dozens of times in a single client interaction. Tasks that require coordination between sales and trading such as order crosses are even more inefficient, requiring copy/pasting into chat, email, spreadsheets, and other tools.

Broker-dealers and investment banks need to maximize the value they provide to their customers. Salespeople must combine in-depth knowledge of their client’s needs, trading habits and objectives, along with comprehensive knowledge of markets, tradable instruments and trends. Traders must understand market dynamics and liquidity, acting quickly on massive amounts of information to accurately and profitably make markets. Unfortunately, critical information like order details, TCA, client profiles and market intelligence often sit in multiple, disconnected applications. Both must constantly switch, search and copy/paste between them, sometimes dozens of times in a single client interaction. Tasks that require coordination between sales and trading such as order crosses are even more inefficient, requiring copy/pasting into chat, email, spreadsheets, and other tools.

This reduces the speed and effectiveness of the service the desk provides and increases the error rate. In today’s high volume, high volatility environment, streamlining sell-side workflows is crucial to staying ahead.

The solution? Interoperability.

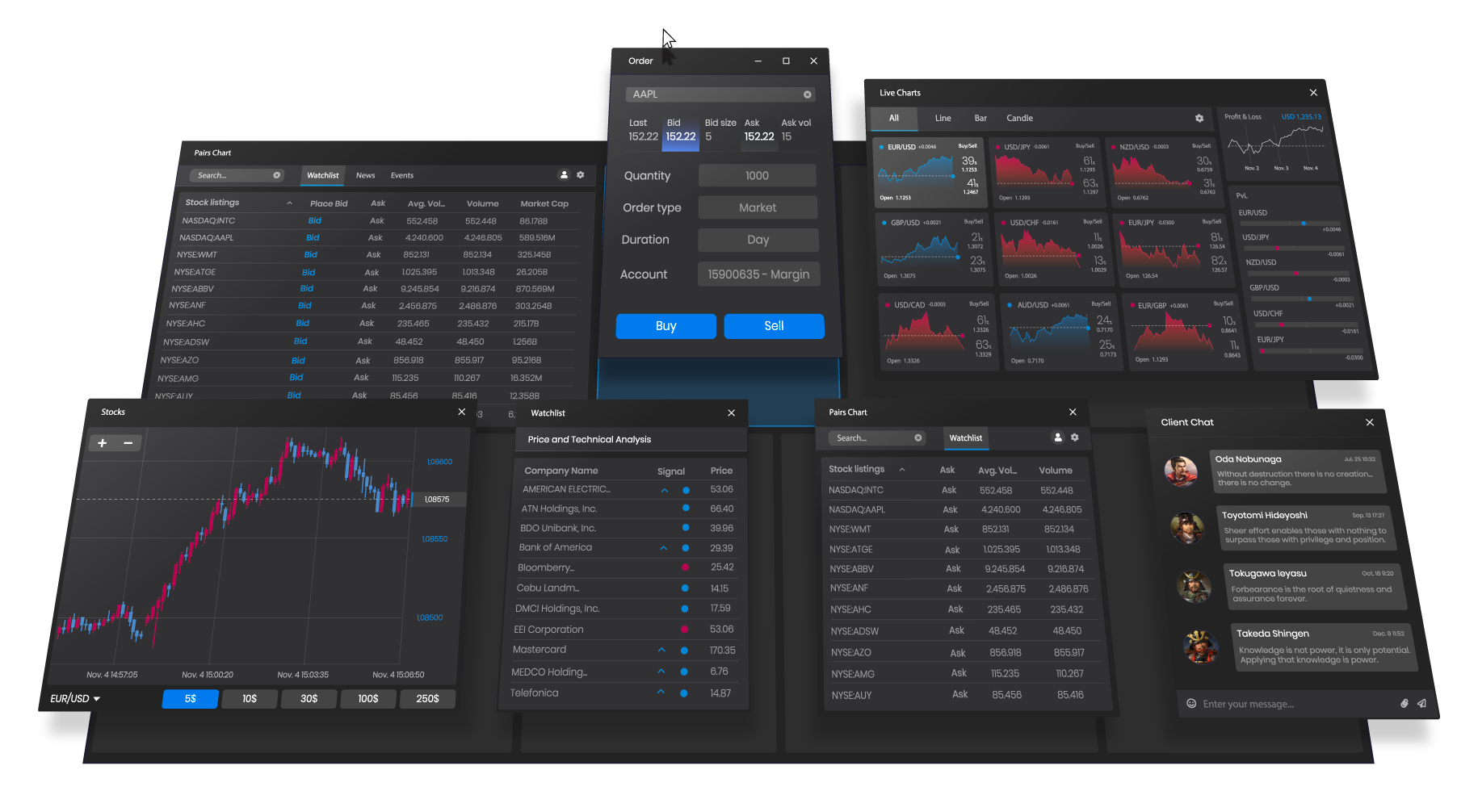

With interop.io, sell-side firms create highly intuitive workspaces where data is tracked and synchronized in real-time between applications of any kind – web, native, in-house or legacy. This means salespeople and traders can increase the speed and quality of client service and order execution, maximize internalization, and better exploit their market knowledge.

- One click access to market intelligence by syncing ticker information between applications.

- One click synchronisation across applications on quotes, pricing, analytics and news for idea generation, faster decision making and best execution.

- At the point of order receipt or execution, click on an order/basket and get pre-trade TCA or relevant analytics for that order/basket in the trader’s analytics platform of choice.

- One click access to client profile, holdings, interests, past orders and more to know who to call and why.

- Have personalized and targeted client conversations: Improve client/broker relationships by having client specific insights at hand when they get in touch.

- Streamlined workflows between sales, trading, research, and the back office, increasing order crossing, reducing time to resolve trade breaks, and other multi-person activities.

Interop is a reality with interop.io

At interop.io we pride ourselves on successful interoperability implementations with short time to value and measurable ROI. Our firm is comprised of committed technologists, thought leaders, and capital markets professionals to create a team of “interop experts” who help to bring projects to life in the real world. We are passionate about what we do.

By bringing best-in-breed interop technologies forward, we have helped firms like Citi and Redburn deploy integrated solutions to sales and trading quickly, eliminating the headache that can come with long (or stalled) IT projects. We understand that technologists may know that the chaotic desktop environment is hurting business, but the burden of too many IT projects, long lists, and failure-rate may hinder action.

Know that with interop.io, interoperability is not an impossibility, it’s a reality. The sooner you contact us, the quicker we can discover a solution catered to your business needs.

A harmony of new and old

interop.io is an enabler of digital transformation without large budgets, long timeframes, or sunsetting of current tools. This allows you to supplement and eventually replace legacy platforms incrementally without turning the lights off. Extend the trading environment through the rapid addition of new applications or micro-frontends. Deliver new functionality or re-purpose existing features from legacy systems. In addition, take advantage of pre-built application adapters (e.g. Bloomberg, Fidessa, Excel, Salesforce, etc.).

Learn more about interop.io adapters.

Advantages of interop.io for technologists

- interop.io allows you to a build a best of breed platform of choice with any-to-any technology integration.

- interop.io has the largest vendor ecosystem for desktop integration allowing you to integrate 3rd party apps and in-house built on different technologies seamlessly

- interop.io allows you to deliver workflow automation to your trading desks in days providing quickest time-to-value and continuous business improvement.

- interop.io offers a zero-installation framework, patented technology, and analytics framework to deliver usage and insights back to the business.

Improved trader performance by

20%

RFQ times reduced by

33%

Improved

broker-client

relationships

There is no silver bullet

From our experience working with global banks and financial institutions, we know that the tools you use vary. There are not one-size-fits all solutions to consolidate every application on the trading floor. With the help of interop.io, any application can be incorporated into a new, streamlined workflow.

The reality of interoperability is quickly becoming commonplace. Reap the benefits of interop today.

Why Loving Legacy Apps is Key to Capital Markets’ Digital Transformation

In this whitepaper, learn how it’s possible to deliver a hybrid environment where legacy and modern applications co-exist in a fully integrated way. Hear from buy and sell sides representatives who have solved for the ‘legacy problem.’

Download whitepaper